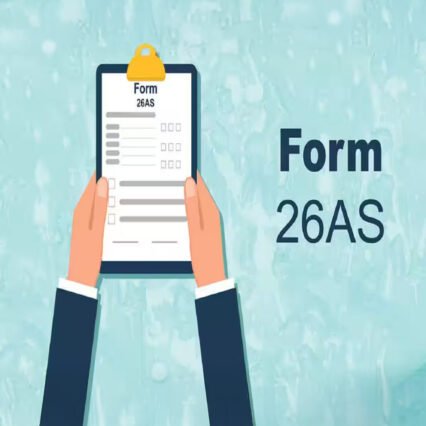

Description

Extracts and analyzes Form 26AS data to verify declared income, TDS deductions, and high-value transactions.

Form 26AS provides a consolidated view of income tax deducted and filed against a PAN number. Our verification ensures that the candidate’s declared financials match with government records, improving risk assessment for employers or lenders.